Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except. The e-filing system is open from March 1st every year to April 30th.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Based on this table there are a few things that youll have to understand.

. The 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from MYR 20001 to MYR 70000. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the. Similarly those with a chargeable.

43 For a resident individual income tax shall be charged upon the chargeable income of the individual at the scale rate as specified in Schedule 1 of the. Reduction of certain individual income tax rates. On the First 5000.

Assessment Year 2018-2019 Chargeable Income. Cancellation Of Disposal Sales Transaction. Purchase of personal computer once every 3 years Alimony.

For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. A non-resident individual is taxed at a flat rate of 30 on total taxable income. What are the income tax rates in Malaysia in 2017-2018.

20182019 Malaysian Tax Booklet Personal Income Tax. My estimated tax relief for YA 2018 is RM2146085 RM1836085. Under the current legislation the income tax structure for resident individuals is based on progressive tax rates ranging from 0 to 28 on chargeable income.

He or she has been resident in Malaysia for less than 182 days of the tax year but was resident in the. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. 62018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below. KUALA LUMPUR Jan 20. Responsibility Of Disposer And Acquirer.

Understanding tax rates and chargeable income. Chargeable income is your taxable income minus any tax deductions and tax relief. She would need to pay RM600 on the first RM35000 and 8 on the remaining RM4060 RM32480 which totals to RM92480.

Introduction Individual Income Tax. 1 Corporate Income Tax 11 General Information Corporate Income Tax. Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060.

Offences Penalties Failure to furnish Income Tax Return RM200 to RM20000 or imprisonment or both on conviction or 300 of tax payable in lieu of prosecution Failure to furnish Income Tax Return for 2 YAs or more RM1000 to RM20000 or imprisonment or. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. So the estimated total amount of my personal tax relief for YA 2018 is RM2146085 RM1836085.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. The last record was set in 2014 when the direct tax collection came in at. Corporate tax rates for companies resident in Malaysia is 24.

23 rows Tax Relief Year 2018. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Imposition Of Penalties And Increases Of Tax.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. 50 income tax exemption on rental income of residential homes. He or she has been resident in Malaysia for 182 days of the tax year.

Calculations RM Rate TaxRM 0 - 5000. Here are the tax rates for personal income tax in Malaysia for YA 2018. Her chargeable income would fall under the 35001 50000 bracket.

Offences under the Income Tax Act 1967 and the penalties thereof include the following. However there is a grace period or an extended deadline for e-filing till May 15th. Nonresident individuals are taxed.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. Income tax rate Malaysia 2018 vs 2017. The Inland Revenue Board of Malaysia achieved a new record in direct tax collection last year with RM137035 billion collected which is 1113 or RM13723 billion more than the RM123312 billion collected in 2017 the Ministry of Finance MoF said today.

20182019 Malaysian Tax Booklet 21 year and in any 3 of the 4 immediately preceding years he was in Malaysia for at. The total tax relief is slightly less than my tax relief for the assessment year 2017 which was RM24335. Individual Life Cycle.

Malaysia implemented e-filing some years ago and it is important to note that taxpayers have now preferred to submit their income tax returns through e-filing. First of all you have to understand what chargeable income is. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Personal income tax in Malaysia is charged at a progressive rate between 0 28. The relevant proposals from an individual tax perspective are summarized below.

Malaysia has a fairly complicated progressive tax system. In Malaysia an individual regardless of citizenship is liable for income tax if he or she fulfils any of the following criteria. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

The amount of tax relief 2018 is determined according to governments graduated scale. The difference was mainly due to I reduced my PRS contribution in 2018 compared. Theres a lower limit of earnings under which no tax is charged - and then a progressively higher tax rate is applied based on how much you earn above that level.

Malaysia Personal Income Tax Guide. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. The 2018 national budget was announced by Malaysias Minister of Finance on 27 October 2017.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Assessment Of Real Property Gain Tax. 13 September 2018 Page 2 of 14 Tax on the balance XX of chargeable income XX XX.

Malaysia Personal Income Tax Rate.

Malaysian Bonus Tax Calculations Mypf My

Apply For Instant Cash Loan Personal Loans Dearness Allowance Cash Loans

Arena Multimedia Lahore Center 8 Days Adobe Photoshop Professional Course With Raheel Ahmed Baig On 7th Janua Arena Multimedia Network Marketing Solutions

Download Teacher Salary Slip Excel Format Exceltemple Teacher Salary Free Resume Template Word Teacher Help

The Top One Percent Net Worth Levels By Age Group Passive Income Investing Spending Problem

Cukai Pendapatan How To File Income Tax In Malaysia

7 Free Printable Budgeting Worksheets Video Video Budgeting Worksheets Budgeting Monthly Budget Template

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Here Are The Tax Reliefs M Sians Can Get Their Money Back For This 2018 World Of Buzz Tax Relief Income Tax

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

New Free Stock Photo Of Hand Pen Writing Tax Guide Inheritance Tax Tax Deductions

Commentary What Struggling Malaysians Need From This Budget Is A Stronger Safety Net And Higher Taxes Cna

Obtaining A Computer Card In Qatar Cards Initials Business

Demurrage Meaning Charges Guide Trade Finance Global

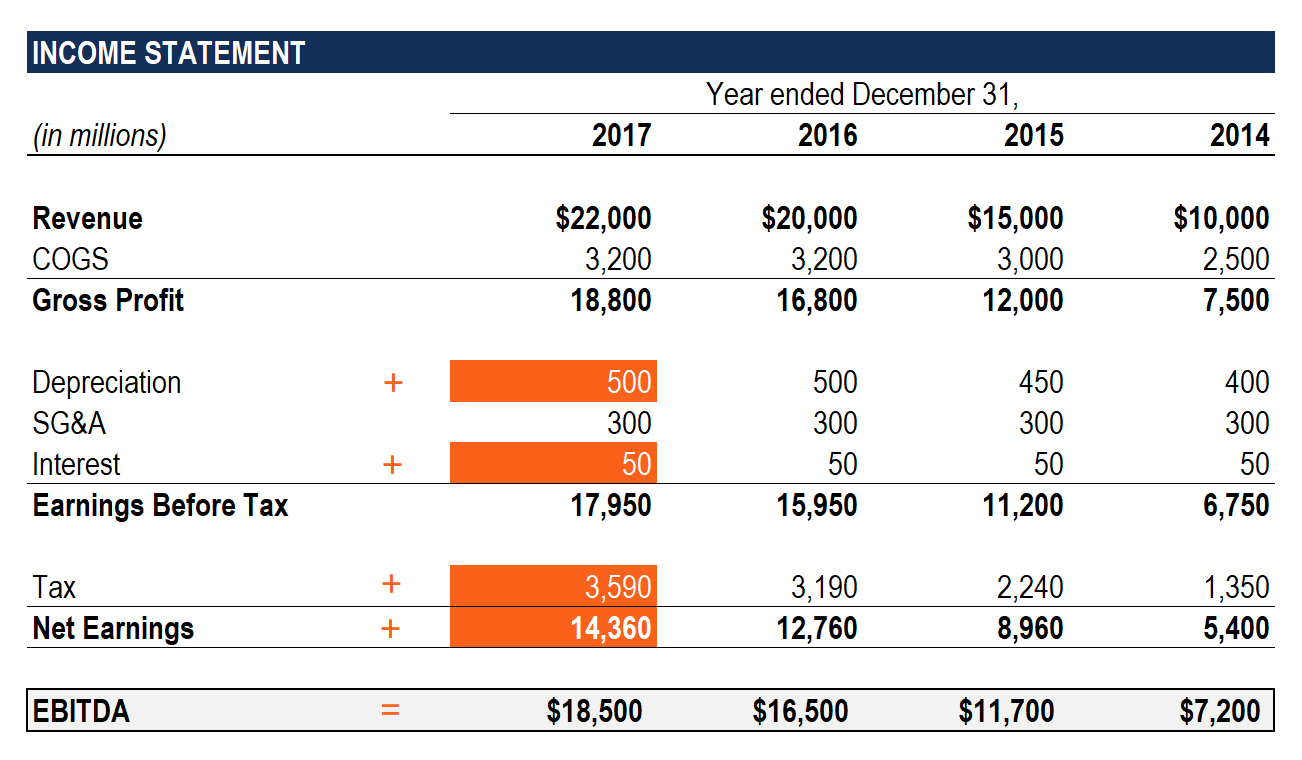

What Is Ebitda Formula Definition And Explanation

Maybank Gold Investment Account Campaign In Malaysia Gold Investments Investment Accounts Investing

एशय कप रमचक मकबल म पकसतन न द अफगनसतन क 3 वकट स मत Asia Cup Asia India